New Jersey Car Accident Lawyer

Legal Assistance With Your Car Accident Case

Our New Jersey car accident lawyer understands the distress and turmoil that follow a car accident. You may be entitled to compensation for your injuries, loss of income, and other damages, but without our seasoned personal injury lawyer by your side, you risk missing out on the full scope of what you’re owed. Leveraging legal knowledge immediately after an accident not only elevates your chances for a fair settlement but also provides you peace of mind, allowing you to focus on your recovery. Contact the Law Offices of David A. DiBrigida today to learn more. Attorney David A. DiBrigida has helped clients maximize compensation from injury accidents since 1992.

Table of Contents

- Legal Assistance With Your Car Accident Case

- New Jersey Car Accident Laws

- Common Types of Car Accident Cases

- New Jersey Car Accident Infographic

- New Jersey Car Accident Statistics

- Car Accident FAQs

- Law Offices of David A. DiBrigida, New Jersey Car Accident Lawyer

- Contact Our New Jersey Car Accident Lawyer Today

When Should You Hire an Attorney

The ideal time to hire an attorney after a car accident is as soon as possible, preferably within the first few days following the incident. Prompt legal guidance can make a significant difference in how your case unfolds. Evidence can quickly become compromised or disappear, witnesses may become difficult to track down, and critical filing deadlines could be missed. Additionally, insurance companies often aim to settle claims quickly and for as little money as possible, potentially taking advantage of your lack of legal knowledge. By engaging our attorney early in the process, you make sure that your rights are protected, that all relevant evidence is preserved, and that you receive skilled counsel in dealings with insurance companies or opposing parties. The sooner you secure legal representation, the better positioned you’ll be to achieve a favorable outcome.

No-Fault Insurance

New Jersey operates under a no-fault insurance system. This means that after an accident, regardless of who caused it, your own insurance policy is responsible for covering your medical bills and economic losses, up to the policy’s limits. The no-fault system was designed to streamline compensation so you can get your medical expenses covered promptly. However, if your injuries are severe, you may have the right to pursue additional compensation from the at-fault party. Severe injuries could include things like fractures, significant scarring, or other conditions that result in permanent harm.

Personal Injury Protection

Personal Injury Protection, or PIP, is a mandatory element of car insurance coverage in New Jersey under its no-fault system. PIP is designed to pay for your medical costs, lost wages, and certain other expenses, regardless of who caused the accident. For example, if you’re unable to work due to your injuries, PIP can cover your lost income. The goal is to provide timely access to medical treatment and compensation for other financial losses, so you don’t have to wait for a determination of fault before getting help. This allows you to focus on recovering rather than worrying about immediate expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage is a type of insurance that offers protection if you’re involved in an accident with someone who either has no insurance or does not have enough insurance to cover the full extent of your damages. If the at-fault driver is uninsured or underinsured, your own policy can step in to cover the remaining costs. This coverage is particularly important because it helps safeguard you from being left with significant out-of-pocket expenses if the other party is unable to fully compensate you for your losses.

New Jersey Car Accident Laws

In the bustling state of New Jersey, car accidents are a common occurrence. Unfortunately, they often result in injuries, property damage, and legal complications. Understanding the specific laws related to car accidents in New Jersey is essential for both residents and visitors who may find themselves in such unfortunate situations. Reach out to our New Jersey car accident attorney if you are involved in a car accident.

Fault-Based System

New Jersey operates under a fault-based system, also known as a tort system, when it comes to car accidents. This means that the person responsible for causing the accident is also responsible for covering the resulting damages. In most cases, it’s the at-fault driver’s insurance company that pays for the injured party’s medical bills, vehicle repairs, and other losses.

Minimum Insurance Requirements

To legally operate a vehicle in New Jersey, you must carry a minimum amount of auto insurance coverage. As of our knowledge cutoff date in September 2021, these requirements include a minimum liability insurance coverage of $15,000 for bodily injury or death of one person, $30,000 for bodily injury or death of more than one person, and $5,000 for property damage. It’s important to note that these requirements may have changed, and it’s advisable to verify the current minimum insurance requirements with the New Jersey Motor Vehicle Commission.

Comparative Negligence

New Jersey follows a modified comparative negligence rule when determining compensation in car accident cases. This means that if you are partially at fault for the accident, your compensation may be reduced in proportion to your level of fault. However, if you are found to be more than 50% at fault for the accident, you may not be eligible to recover any compensation. Our vehicle accident lawyer will help you figure out whether or not you are responsible and how to move forward.

Statute Of Limitations

In New Jersey, there is a time limit, known as the statute of limitations, for filing a car accident lawsuit. The statute of limitations for personal injury claims arising from car accidents is generally two years from the date of the accident. For property damage claims, it’s typically six years. These time limits can vary depending on the specific circumstances of the case, so it’s vital to consult with our personal injury attorney to file your lawsuit within the applicable deadline.

No-Fault Insurance

New Jersey is also a no-fault insurance state. This means that regardless of who is at fault for the accident, your own insurance company will cover your medical expenses, up to your policy’s limits. However, if your injuries are severe or meet certain criteria, you may be eligible to step outside the no-fault system and pursue a liability claim against the at-fault driver.

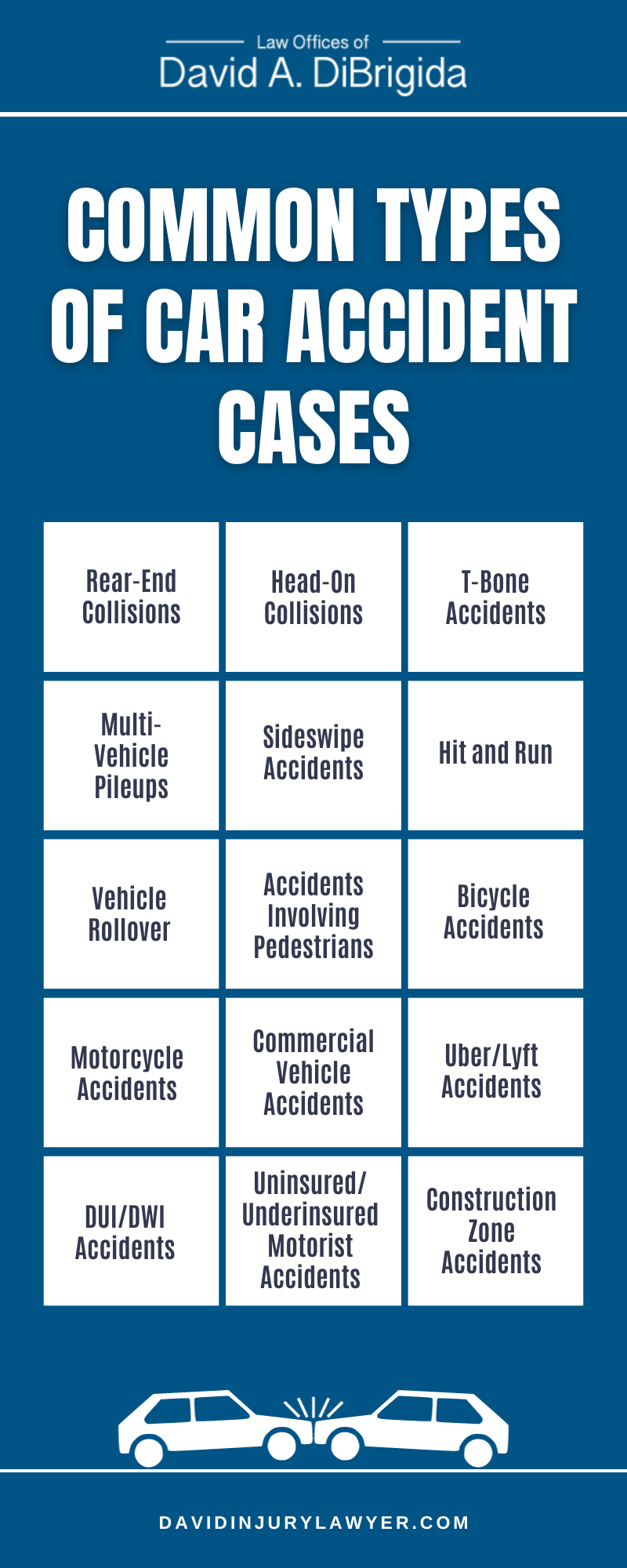

Common Types of Car Accident Cases

Car accidents in New Jersey can take various forms, each with its own set of legal considerations. Below is a list of common types of car accident cases that occur in the state.

- Rear-End Collisions

These accidents, characterized by one car hitting another from behind, are not only common but also highlight the importance of maintaining a safe following distance. Liability typically rests with the driver who failed to stop in time, often due to distraction, speeding, or adverse weather conditions. These collisions can range from minor fender benders to severe crashes, depending on the speed at impact and other circumstances.

- Head-On Collisions

Marked by their high fatality rate, head-on collisions occur when the fronts of two vehicles collide. These accidents are often the result of wrong-way driving, distracted driving, or driving under the influence. The force of impact in such collisions is significantly magnified due to the combined speed of both vehicles, leading to catastrophic outcomes.

- T-Bone Accidents

These incidents usually happen at intersections when one vehicle crashes into the side of another. They often occur due to failures in obeying traffic signals or signs, or when a driver attempts to run a red light. The side of a vehicle offers less protection to passengers than the front or rear, making injuries from these accidents particularly severe.

- Multi-Vehicle Pileups

Occurring primarily on highways or under conditions of poor visibility, these pileups involve multiple vehicles and can result from a chain reaction of collisions. The challenges of determining fault in such accidents can be overwhelming, as it involves piecing together the actions of numerous drivers. The aftermath can block roads for hours and result in significant injuries and damage.

- Sideswipe Accidents

These occur when the sides of two parallel vehicles make contact, often because one or both drivers veer out of their lanes. Such incidents can lead to loss of vehicle control, causing further accidents or rollovers, especially at high speeds. Sideswipe accidents are common on multi-lane roads and are often attributed to distractions, intoxication, or failure to check blind spots.

- Hit and Run

This cowardly act involves a driver causing an accident and then leaving the scene without identifying themselves or aiding the other involved parties. Hit and run accident victims are left to deal with potential injuries and damages without immediate accountability from the at-fault party, complicating legal and insurance proceedings.

- Vehicle Rollover

A particularly terrifying type of accident, vehicle rollovers often result from sharp turns at high speeds or collisions with obstacles or other vehicles. These accidents are more common among SUVs and vans due to their higher center of gravity. Rollovers can lead to severe injuries or fatalities, especially if seatbelts are not used.

- Accidents Involving Pedestrians

When a vehicle strikes a pedestrian, the consequences can be devastating due to the unprotected nature of the pedestrian. These accidents often occur in crosswalks, on sidewalks, or when vehicles are making turns through pedestrian pathways. Distraction, speeding, and failing to yield are common causes.

- Bicycle Accidents

Cyclists are vulnerable to significant injuries when involved in collisions with motor vehicles, particularly at intersections or within bike lanes. Bike accidents often result from drivers not respecting the cyclist’s right of way or failing to observe their presence due to blind spots or distractions.

- Motorcycle Accidents

Motorcyclists face a high risk of injury in collisions with cars, as they lack the protective enclosure of a vehicle. These accidents are frequently caused by visibility issues, where drivers fail to notice the motorcycle, or by risky maneuvers from either party. The injuries to motorcyclists can be severe, given the limited protection they have.

- Commercial Vehicle Accidents

Involving trucks, vans, and other vehicles used for business purposes, these truck accidents pose unique challenges due to the size and weight of commercial vehicles. Liability and insurance matters become more complicated, often involving federal and state regulations specific to commercial transportation.

- Uber/Lyft Accidents

Ride-sharing services introduce a novel set of insurance and liability questions in the event of an accident. Both drivers and passengers can face uncertainties regarding coverage, with the companies’ policies and the personal insurance of the driver coming into play.

- DUI/DWI Accidents

Driving under the influence of alcohol or drugs significantly increases the risk of causing an accident. These incidents not only lead to civil liabilities but can also result in criminal charges against the intoxicated driver. The recklessness involved in DUI/DWI accidents often results in severe injuries or fatalities.

- Uninsured/Underinsured Motorist Accidents

These accidents involve at-fault drivers lacking sufficient insurance coverage to compensate for the damages caused. Victims may face challenges in receiving adequate compensation, often having to rely on their insurance policies or facing out-of-pocket expenses.

- Construction Zone Accidents

Accidents in construction zones are fraught with additional hazards, including altered traffic patterns, narrow lanes, and the presence of workers and machinery. These conditions increase the likelihood of accidents, which can carry heavier penalties and complicated liability issues due to the increased risk to construction workers and the public.

New Jersey Car Accident Infographic

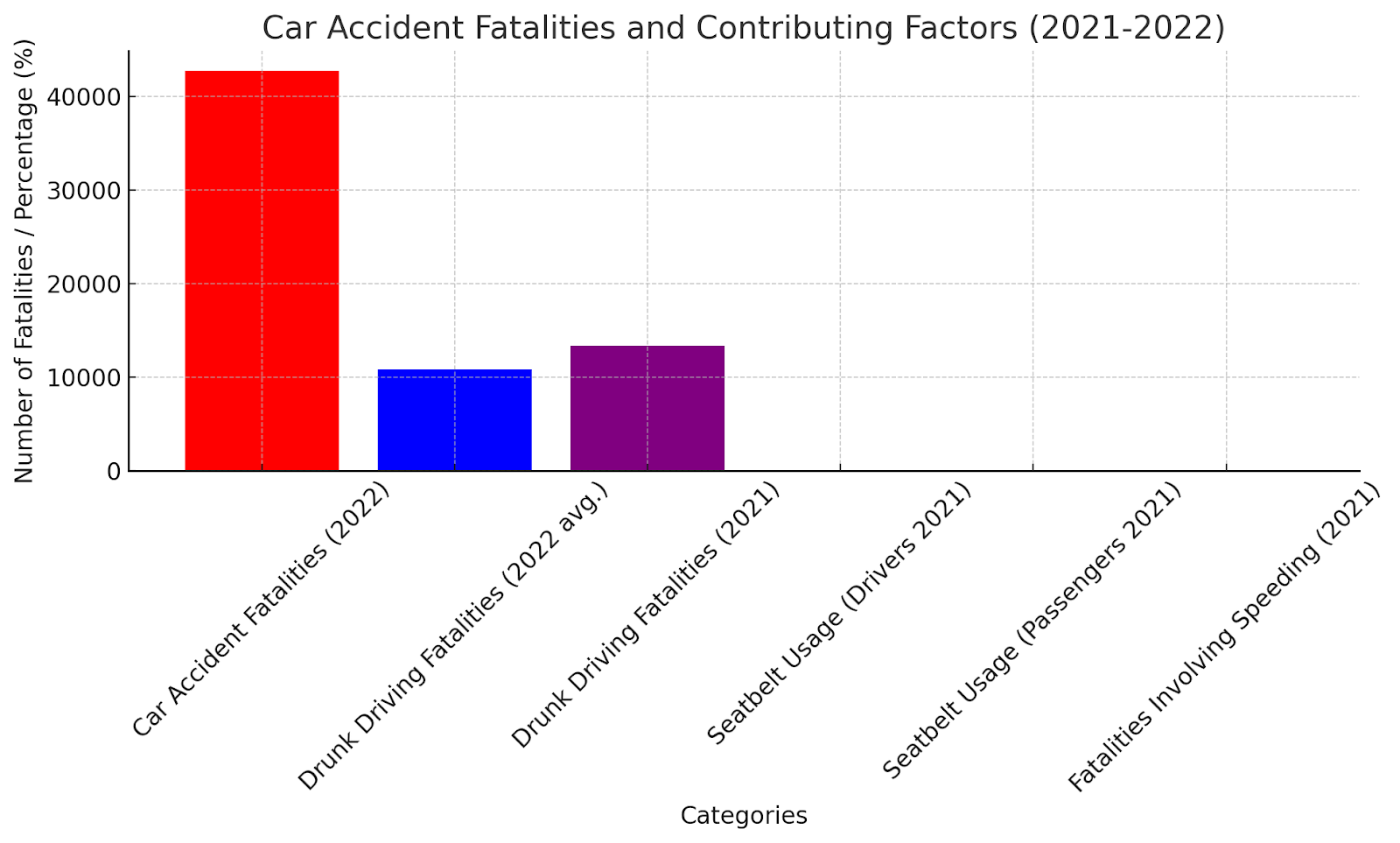

New Jersey Car Accident Statistics

According to the most recent report from the NHTSA, there were 42,795 car accident fatalities in 2022, a 0.3 percent decrease from 2021. Drunk drivers cause an average of 10,850 fatalities every year. In 2021, there was a 14 percent increase in drunk driving fatalities over 2020, with 13,384 drunk driving-related deaths. Of those fatally injured in a passenger vehicle, 44 percent of drivers and 41 percent of passengers were wearing their seatbelts. 29 percent of motor vehicle crash deaths in 2021 involved speeding.

Car Accident FAQs

How long does it take to get a settlement?

The time it takes to secure a settlement in a car accident case varies depending on numerous factors, such as the details of the case, the willingness of parties to mediate, and the backlog of the legal system. In straightforward cases with clear liability and well-documented injuries, a settlement could be reached within a few months.

However, for more complicated scenarios, such as those involving severe injuries, multiple parties, or disputed liability, the process can stretch on for a year or even longer. Insurance companies often engage in lengthy negotiations to minimize payouts, and sometimes a settlement is only reached on the eve of a trial. It’s essential to consult our experienced New Jersey car accident attorney for a tailored estimate and to manage the steps of the settlement process effectively.

Can you sue for a car accident in NJ?

Yes, you can sue for a car accident in New Jersey, but the state’s “no-fault” insurance system does impose certain limitations. Under this system, you generally file a claim with your own insurance company for medical expenses and other out-of-pocket costs, regardless of who was at fault.

However, you can step outside of this no-fault system and file a lawsuit against the at-fault driver if you meet certain thresholds. Specifically, if you’ve sustained “serious” injuries that result in significant medical expenses, permanent injury, significant disfigurement or scarring, or a long-term impact to your quality of life, you may be eligible to pursue a claim for additional damages like pain and suffering. Due to the confusing nature of New Jersey’s car accident laws, retaining legal guidance from our experienced attorney is highly recommended to assess the viability of your case.

What to do if someone sues you for a car accident in NJ?

If you find yourself being sued for a car accident in New Jersey, it’s vital to take immediate action to protect your interests. First and foremost, do not ignore the lawsuit; failing to respond could result in a default judgment against you. Contact your insurance company as soon as you receive the lawsuit papers, as they may provide legal representation under the terms of your policy.

Additionally, consult with our experienced attorney who specializes in car accident litigation. Our injury lawyer can guide you through the proceedings of New Jersey’s legal system, help formulate a defense strategy, and represent you in court if necessary. Keep all documentation and evidence related to the accident, as this will be important for building your defense.

Do you need a police report to file an insurance claim in NJ?

In New Jersey, a police report is not strictly required to file an insurance claim for a car accident, but it is highly recommended. A police report serves as an official record of the incident and typically includes important details such as the names of the parties involved, witness accounts, and an initial assessment of fault.

This document can provide valuable evidence when negotiating with insurance companies or if a legal dispute arises later. Some insurance companies may even require a police report, especially for accidents involving substantial damage or injury. Therefore, if you’re involved in a car accident in New Jersey, it’s advisable to contact the police and have a report filed to bolster your insurance claim and protect your interests.

How Do You Pursue Compensation After a New Jersey Car Accident?

Pursuing compensation after a car accident in New Jersey often starts with filing a claim with your own insurance company, thanks to the state’s no-fault insurance system. This covers your medical expenses and other out-of-pocket costs up to the limits of your policy.

However, if your injuries are severe, exceed certain thresholds, or if another party is clearly at fault, you may step outside the no-fault system to file a claim against the other driver’s insurance or even initiate a lawsuit. Documentation is critical in this process; gather all medical records, repair bills, and evidence like photographs or eyewitness accounts.

Car Accident Glossary

Legal services are often essential in helping clients handle insurance claims, access medical care, and recover lost income after a car crash. Because our legal system in New Jersey has specific rules and processes for auto-related injuries, it’s important for those involved in an accident to understand several key legal terms. Below, we define five essential phrases you might encounter if you’ve been injured in a New Jersey car accident and are seeking legal representation.

Personal Injury Protection (PIP)

Personal Injury Protection, commonly known as PIP, is required by law for all drivers in New Jersey. This coverage pays for your medical expenses and lost wages after a car accident, regardless of who was involved or how the accident occurred.

PIP is part of New Jersey’s no-fault system and is designed to offer immediate financial assistance following a crash. Depending on your policy, PIP may also reimburse costs like household services or funeral expenses. Although it seems straightforward, the process for submitting a PIP claim and getting full reimbursement often involves strict documentation and deadlines.

No-Fault Insurance System

New Jersey uses a no-fault insurance model. After an accident, your own car insurance policy is responsible for paying your basic medical expenses under PIP, regardless of who caused the crash.

The intention behind this system is to reduce delays in receiving necessary care by avoiding early disputes over blame. However, no-fault coverage doesn’t apply to all types of losses. If your injuries meet the legal definition of “serious,” you may be allowed to pursue additional compensation through the other driver’s insurance or by filing a lawsuit. This often requires legal review to determine whether your injuries fall under the applicable exception criteria.

Uninsured and Underinsured Motorist Coverage

Uninsured and Underinsured Motorist Coverage, often referred to as UM/UIM, is an optional but highly recommended insurance provision. It offers financial protection when you’re in an accident with a driver who either lacks any insurance or doesn’t have enough insurance to cover your medical bills and related losses.

If the at-fault party can’t pay, this coverage steps in to help with expenses like hospital bills, rehabilitation, or ongoing treatment. In many cases, UM/UIM coverage is the only way to avoid substantial out-of-pocket costs after a serious crash, especially when a hit-and-run driver is involved or when the responsible party carries only minimal insurance.

Minimum Insurance Requirements

To drive legally in New Jersey, vehicle owners must carry specific minimum levels of car insurance. These include liability coverage of at least $15,000 for injury or death of one person, $30,000 for multiple people, and $5,000 for property damage.

While these amounts are the legal minimum, they are often insufficient in serious accidents. Many drivers opt for higher limits or additional coverage types, such as PIP or UM/UIM, to better protect themselves financially. Understanding these requirements helps you avoid fines and legal issues—and ensures you’re better prepared in the event of an accident.

Serious Injury Threshold

The serious injury threshold determines whether you can file a lawsuit against another driver after a crash in New Jersey. Under the no-fault system, you typically seek compensation from your own insurer, but exceptions exist for severe cases.

Injuries that may qualify include disfigurement, loss of a body function, fractures, or other permanent harm. If your injury meets the threshold, you can step outside the no-fault rules and file a claim directly against the other party. Legal support is often necessary to prove that your injury meets this threshold, as it requires detailed medical records and legal documentation.

If you’ve been in a car accident and are unsure about your legal options, it’s a good idea to speak with our qualified New Jersey car accident lawyer. At the Law Offices of David A. DiBrigida, we help clients across the state understand their insurance coverage, evaluate the seriousness of their injuries, and pursue the compensation they are entitled to.

Let’s talk about your case—contact us today to schedule a free consultation and find out how we can support your recovery.

Law Offices of David A. DiBrigida, New Jersey Car Accident Lawyer

101 Eisenhower Pkwy #100, Roseland, NJ 07068

Contact Our New Jersey Car Accident Lawyer Today

David A. DiBrigida handles auto accident injury cases in New Jersey. He will evaluate the factors contributing to the value of your damages and personally handle your case from start to finish. If you have been injured in an auto accident, you need our New Jersey car accident lawyer who understands and is knowledgeable about your rights as a car crash injury victim. To protect your legal rights, call David today at 800-322-5529 for a FREE consultation.